Contents

The gold to silver ratio illustrates how valuable gold is in comparison to silver and can shed light on potential price movements between the two metals.

To calculate the gold / silver ratio, divide the current gold price by the current silver price to get the current ratio number.

Investors use the Gold/Silver Ratio to trade because it is a straightforward indicator of which of the two main precious metals is appreciating in value compared to the other.

This ratio reflects the quantity of silver you would need to sell in order to acquire one ounce of gold or the quantity of silver you could purchase with the proceeds from the sale of one ounce of gold.

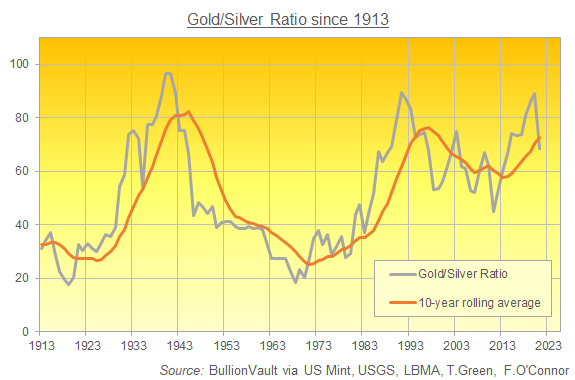

Although technically there is no reason why the ratio couldn't go higher or lower than those ranges, it often stays between 10 and 100.

Due to the daily fluctuations in the price of gold and silver, this ratio might change. The ratio will increase if gold performs better than silver, and vice versa.

Even if gold and silver move in the same direction, the ratio might change since it records the relative worth.

We examine the ratio because it may offer a hint as to which of the two precious metals will likely perform better in the future.

As an illustration, the ratio is now at 72 and historically, it is close to 64, which is the lowest level since 2014.

For the majority of the past ten years, 80 to 84 has been the highest level, but in March 2020, as the price of gold soared, the ratio shot up to 117.

However, the ratio progressively decreased to its present level of 72 as gold outperformed silver.

Due to the ratio being close to its base levels and having greater upward potential, gold may now beat silver.

The price of each metal and how quickly it is increasing or decreasing in relation to the other determine the gold to silver ratio.

Gold and silver were both utilized as currency throughout history, and these two precious metals were used to create coins.

This made the gold-to-silver price ratio an important indicator in daily life since any significant deviation from more normal levels may cost you dearly if you choose to accept silver coins as payment - or it could result in a windfall profit when the ratio returned to its average!

Today's gold investors generally agree that the ratio should trade in accordance with the actual gold to the silver content of the earth's crust.

In the past, the two metals' relative values were undoubtedly influenced by their availability.

It is crucial to emphasize that the values of gold and silver are decided and driven by their own variables, even though some factors, such as changes in the US dollar, can affect the price of both metals.

The price of gold is mostly influenced by investor mood, which rises during uncertain times as more individuals want to purchase the metal as insurance against potential reductions in other components of their investment portfolio.

The price of silver, which has more industrial uses than its sister metal and is more expensive, is less affected by this.

For this reason, some people use the gold to silver ratio to gauge investor sentiment: if the ratio is high, it indicates that gold has increased in value more quickly than silver,

Indicating that investors are becoming more risk-averse; conversely, a low ratio could indicate that interest in gold has decreased, indicating that investors are confident in the expansion and stability of the global economy.

The gold to silver ratio shows how valuable one metal is in relation to the other and may be used to determine whether one metal may be undervalued or overpriced.

Due to the stability of prices in comparison to other instruments, it is the best use for a longer-term strategy. This is true whether you're a self-directed investor or working with a dealer.

The ratio alters when the prices of gold and silver move in opposite directions or, more frequently, when one increases or decreases more quickly than the other.

A high ratio denotes that gold is more expensive than silver, whilst a low ratio denotes the exact opposite.

The ratio is a useful technique that can be applied outside of precious metals trading since it can be used to determine how the market feels about the bigger picture.

When the global economy is slowing and there is a lot of uncertainty, as it has currently, a high ratio has historically preceded economic downturns. When there is peace and prosperity, a low ratio is frequently observed.

Keep in mind that the ratio may stay at extreme levels for a considerable amount of time even though it may be a useful tool for deciding to go overweight on gold or silver. As a result, it shouldn't be used alone.

To put it simply, the gold/silver ratio is a common indicator used by precious metals investors worldwide, and it is a straightforward numerical computation that demonstrates how many multiples gold is trading compared to the price of silver.

Although many of the same variables, such as inflation and the public perception of other investments, frequently impact their price changes, their prices don't necessarily change at the same rate.

The connection between the two precious metals has therefore changed significantly throughout time.

If precious metals undergo another boom, the silver price may surge, dramatically tightening the ratio, according to past tendencies.

Silver is becoming more and more significant on the internet and with new trends.

Sports technology firms, for instance, have created wearable devices (some of which use silver in their components) and smartphone applications to measure physical activity like your heart rate, any calories consumed or burned off, as well as other biometric feedback tools to monitor our well-being while we are on the road.

Apart from the potential rise in demand from conventional industries and rising economies, this industry alone has increased demand for this precious metal.

Although the gold-to-silver ratio appears to be high at the moment, given how attitudes are changing and how much demand is growing, silver prices for bars and coins may rise significantly in the future.